ETH Price Prediction: 2025-2040 Outlook and Key Market Drivers

#ETH

- Technical indicators show ETH consolidating below its 20-day MA with strong MACD momentum suggesting underlying bullish sentiment

- Mixed news sentiment with positive institutional adoption offset by significant ETF outflows requiring careful monitoring

- Long-term price projections remain optimistic based on Ethereum's fundamental ecosystem strength and growing institutional infrastructure

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Amid Current Volatility

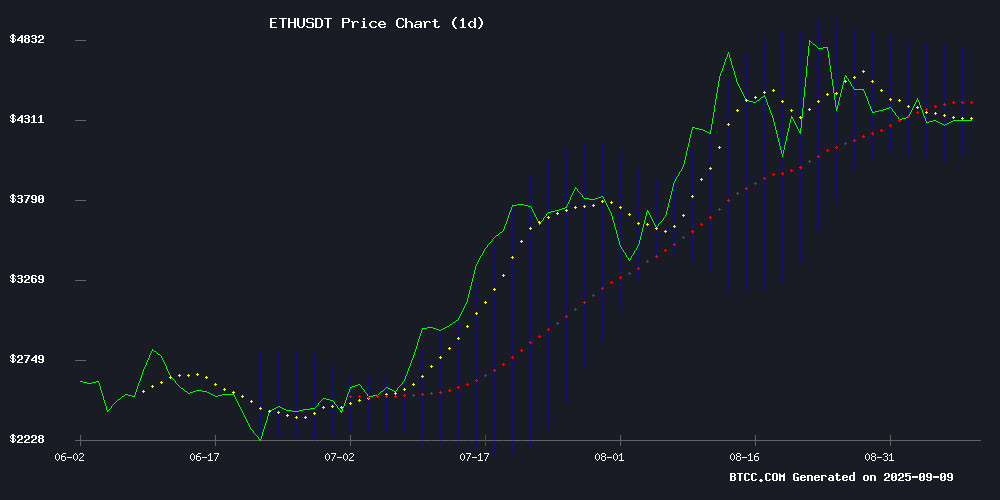

ETH is currently trading at $4,352.61, sitting below its 20-day moving average of $4,433.56, indicating potential short-term bearish pressure. The MACD reading of 100.73 suggests bullish momentum remains intact despite recent pullbacks. Bollinger Bands show ETH trading NEAR the middle band with upper resistance at $4,785.56 and support at $4,081.55. According to BTCC financial analyst James, 'The technical picture suggests consolidation between $4,080 and $4,780 in the near term, with a breakout above the 20-day MA needed for renewed bullish momentum.'

Market Sentiment: Institutional Developments Offset by ETF Outflow Concerns

Recent developments show contrasting forces influencing ETH sentiment. Positive institutional adoption includes ARK Invest's increased BitMine exposure and Upbit's Layer-2 launch, while concerning outflows of $912 million from ETH ETFs create headwinds. BTCC financial analyst James notes, 'The $8.9 billion Ethereum treasury and major Layer-2 upgrades provide fundamental strength, but sustained ETF outflows require monitoring. Overall, institutional infrastructure growth supports long-term Optimism despite short-term outflow pressures.'

Factors Influencing ETH's Price

ARK Invest Amplifies Bet on BitMine as Ethereum Treasury Swells to $8.9 Billion

Cathie Wood's ARK Invest made a decisive $4.4 million purchase of BitMine Immersion Technologies shares across three ETFs, signaling intensified conviction in the Ethereum-focused firm. The move coincides with BitMine's treasury crossing 2 million ETH ($8.9 billion) - now representing 1.7% of Ethereum's total supply and 42% of corporate ETH holdings.

ARK's allocation spanned its Innovation ETF (67,700 shares), Next Generation Internet ETF (21,890 shares), and Fintech Innovation ETF (12,360 shares), bringing total exposure to 6.7 million shares worth $284 million. BitMine stock responded with a 4.1% gain, extending its year-to-date rally to 460%.

The investment firm simultaneously liquidated $5.13 million in Robinhood shares following a 15.8% surge on S&P 500 inclusion news, demonstrating active portfolio rebalancing toward crypto-native assets.

Upbit Launches Ethereum Layer-2 Blockchain Giwa in Strategic Web3 Push

South Korea's dominant cryptocurrency exchange Upbit has unveiled Giwa, an Ethereum layer-2 blockchain built using Optimism's OP Stack. The testnet version, operational as Giwa Sepolia, achieves one-second block times while leveraging Ethereum's security layer—a technical feat that positions Upbit as more than just a trading platform.

The rollout coincides with Upbit's 73% market share in South Korea's crypto sector, where the exchange processes $2.5 billion in daily volume. Giwa's architecture reflects deliberate cultural symbolism, named after traditional Korean roofing tiles that represent protection and heritage—an apt metaphor for blockchain security.

With over 4 million testnet blocks already mined, Upbit signals serious infrastructure ambitions. The move capitalizes on South Korea's status as the world's second-largest crypto market by fiat on-ramp volume, per Chainalysis data.

Ethereum Faces Sustained Selling Pressure as ETF Outflows Hit $912 Million

Ethereum's price struggles to reclaim the $4,500 resistance level after ten days of failed attempts, with a descending triangle pattern suggesting potential downside toward $3,550. The asset has formed lower highs since its August peak near $4,950, reflecting weakening momentum despite favorable macroeconomic conditions.

Spot Ethereum ETFs bled $912 million over seven consecutive trading days, contributing to a broader $352 million outflow across digital asset products. Network activity and revenue plunged 44% in August—a stark divergence from price action that saw ETH test record highs earlier that month.

Futures markets echo the caution, with open interest down 18% from its $70 billion peak. The erosion of leverage demand and spot liquidity creates a technical trap below $4,500, now acting as firm resistance after previously serving as support.

Ronin Network Upgrades to Ethereum Layer 2 with Optimism

Ronin Network is making a strategic leap to Ethereum Layer 2 by adopting Optimism’s OP Stack, a move that promises to slash transaction times by 15x while bolstering security. The upgrade, backed by $5-7 million in milestone grants, integrates Ronin into the Superchain ecosystem—linking it to heavyweights like Base and Uniswap.

This pivot underscores Ronin’s ambition to dominate the trifecta of gaming, DeFi, and NFTs. Faster settlements and seamless interoperability could redefine user expectations for blockchain-powered applications. The network’s alignment with Ethereum’s scaling solutions signals a broader industry shift toward modular architectures.

Ethereum Layer 2 Project Kinto Shuts Down After $1.55M Exploit

Kinto, an Ethereum Layer 2 project built on Arbitrum, is winding down operations following a devastating smart contract exploit in July. The breach allowed an attacker to mint 110,000 counterfeit tokens and drain $1.55 million from lending pools, triggering a 95% collapse in Kinto's native token value.

The team attempted recovery through a $1 million 'Phoenix' initiative to compensate users and restart trading, but the financial damage proved insurmountable. This incident underscores the persistent security challenges facing decentralized finance protocols, particularly in Layer 2 ecosystems where smart contract vulnerabilities can have catastrophic consequences.

While no exchanges were directly compromised, the collapse affects Ethereum-based DeFi infrastructure. The shutdown highlights how single points of failure continue to plague crypto projects despite advances in blockchain security.

Luca Netz: The Vision Behind Pudgy Penguins’ Big Comeback

Luca Netz, born Luca Schnetzler, has emerged as the unlikely hero behind the resurgence of Pudgy Penguins, a collection of pastel-colored digital birds that transitioned from NFT novelty to mainstream retail. His journey—marked by resilience and relentless hustle—reflects the volatile yet transformative potential of crypto-native projects.

Netz's early life was defined by instability. As the child of an immigrant mother, he moved across continents, from South Africa to Los Angeles, often facing financial hardship. By 15, he was organizing underground rap shows in South Central LA, a venture that taught him the razor-thin margin between opportunity and peril.

A warehouse job at Ring Doorbell became his first exposure to scalable innovation. Witnessing Amazon's $1 billion acquisition of the company planted the seeds for his later ventures. In July 2021, Pudgy Penguins launched as a quirky Ethereum-based NFT project. Despite early struggles, Netz's leadership has since propelled it into a cultural and commercial force, with partnerships like Walmart cementing its crossover appeal.

ETHZilla’s Ethereum Holdings Surge to $500M Amid CEO Transition

ETHZilla Corporation has amassed 102,246 ETH worth $443 million at current prices, alongside $213 million in cash reserves. The aggressive accumulation reflects a strategic pivot toward on-chain treasury management, mirroring broader institutional crypto adoption trends in 2025.

Cumberland provided $80 million in financing collateralized by ETHZilla's ether holdings, while the company repurchased 2.2 million shares under its buyback program. "Our treasury strategy positions us as a public market leader in crypto-native balance sheet management," said incoming CEO McAndrew Rudisill, who succeeds Blair Jordan effective September 4.

MegaETH Launches USDm Stablecoin to Tackle Rising Network Costs

MegaETH has introduced USDm, a new stablecoin developed in partnership with Ethena, aimed at reducing gas fees and fostering ecosystem growth. The stablecoin is designed for real-time applications on MegaETH, offering seamless integration with wallets and on-chain services.

Unlike traditional L2 networks that rely on sequencer fees, MegaETH leverages stablecoin yields to fund operations, eliminating the need for user fees. Co-founder Shuyao Kong highlighted the benefits: "USDm means lower fees for users and a more expressive design space for applications."

USDm v1 is backed by BlackRock's tokenized U.S. Treasury fund (BUIDL) via Securitize, ensuring transparent reserves and predictable yields. The system also allows for flexible collateral adjustments, providing adaptability as market conditions evolve.

Etherscan Launches Point Redemption for New Ethereum Loyalty Program

Etherscan, the dominant block explorer for the Ethereum network, has activated the redemption phase of its loyalty initiative, the Etherscan Points System. The program, unveiled on September 8, 2025, enables registered users to exchange accumulated points for exclusive rewards, targeting builders, researchers, and routine platform users.

Points are earned through time-bound campaigns, with the platform emphasizing enhanced on-chain navigation tools as core benefits. The terms of service, effective since August 12, explicitly state these points carry no monetary value, positioning them strictly as utility tokens for platform privileges.

Ethereum Surges Amid ETF Optimism as Cloud Mining Offers Passive Income

Ether has reclaimed its position as the cryptocurrency market's standout performer, rallying sharply on growing speculation that regulators may approve a spot Ethereum ETF. The potential influx of institutional capital through such a product mirrors the liquidity surge observed following Bitcoin ETF launches, creating a bullish catalyst for ETH's valuation.

FY Energy, positioning itself as the world's largest cloud mining operation, is capitalizing on this momentum by offering retail investors simplified exposure to mining rewards. The platform eliminates technical barriers and upfront hardware costs, framing cloud mining as an accessible vehicle for passive income during ETH's price appreciation.

Market participants appear to be front-running a potential ETF decision, accumulating ETH in anticipation of structural demand shifts. The convergence of speculative ETF positioning and yield-generating mining solutions reflects the maturing infrastructure surrounding Ethereum's ecosystem.

Is Ethereum (ETH) A Good Investment? Key Factors for 2025

Ethereum trades near $4,341 after a 2024 rebound, buoyed by the July approval of spot-ETH ETFs—a watershed moment for institutional access. Over 35.7 million ETH (31% of supply) now sits staked, constricting liquid circulation while Layer-2 scaling solutions like EIP-4844 drive down transaction costs.

The network’s fundamentals appear robust: $90–96 billion in DeFi TVL anchors real economic activity, while 500,000 daily active addresses signal persistent adoption. Analysts project a $5,000–$7,000 price range for 2025 assuming sustained ETF inflows and macro stability, with long-term models eyeing $10,000 by 2030.

Risks linger. Regulatory uncertainty shadows the asset class, and 2024’s $2.2 billion in DeFi exploits underscores persistent security vulnerabilities. Yet Ethereum’s developer moat—bolstered by rollup composability—maintains its edge against faster Layer-1 competitors.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, here's a projected outlook for Ethereum:

| Year | Price Prediction | Key Drivers |

|---|---|---|

| 2025 | $5,000 - $7,500 | ETF adoption, Layer-2 scaling solutions |

| 2030 | $12,000 - $20,000 | Institutional adoption, DeFi maturation |

| 2035 | $25,000 - $40,000 | Global blockchain integration, Web3 expansion |

| 2040 | $50,000 - $100,000+ | Mainstream financial infrastructure replacement |

BTCC financial analyst James emphasizes that 'these projections assume continued network development and broader cryptocurrency adoption. Short-term volatility should be expected, but the long-term trajectory remains fundamentally strong due to Ethereum's established ecosystem and ongoing upgrades.'